The luxury fashion world is abuzz with the news of Prada’s acquisition of Versace, a monumental $1.4 billion deal that unites two iconic Italian fashion houses under one roof while reshaping luxury fashion.

Announced on April 10, 2025, this acquisition marks a pivotal moment for the global luxury industry, signaling Prada’s ambition to build a formidable Italian luxury conglomerate to rival French giants like LVMH and Kering. We’ll dive into the history of Prada and Versace, analyze their recent performance, and evaluate whether this Prada-Versace deal makes strategic sense.

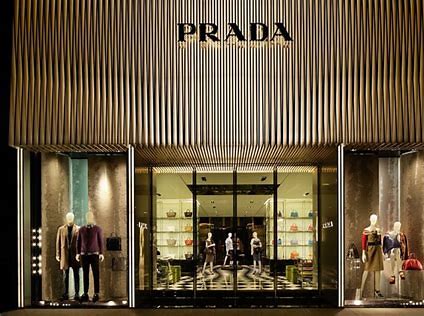

A Brief History of Prada: From Leather Goods to Global Fashion Powerhouse

The Origins of Prada

Founded in 1913 by Mario Prada in Milan, Italy, Prada began as a small leather goods shop specializing in high-quality trunks and handbags. The brand’s early success was rooted in its commitment to craftsmanship and Made in Italy heritage, a hallmark that continues to define its identity. It wasn’t until Miuccia Prada, Mario’s granddaughter, took the reins in 1978 that Prada transformed into a global fashion juggernaut. Miuccia’s intellectual approach to design—blending minimalist aesthetics with subversive, avant-garde elements—redefined luxury fashion. Her “ugly chic” philosophy, characterized by unconventional fabrics and bold silhouettes, resonated with a new generation of fashion enthusiasts.

Prada’s Expansion and Miu Miu’s Meteoric Rise

In the 1990s, Prada expanded its portfolio, launching the youth-driven Miu Miu brand in 1992, named after Miuccia’s nickname. Miu Miu’s playful, rebellious aesthetic quickly gained a cult following, and by 2024, it reported nearly £1 billion in sales, nearly doubling its profits year-over-year. Prada also acquired brands like Church’s, Car Shoe, and Marchesi 1824, diversifying its luxury offerings. Despite earlier missteps with acquisitions like Jil Sander and Helmut Lang in the late 1990s, Prada has since honed its strategy, focusing on sustainable growth and operational excellence. Today, Prada Group, listed in Hong Kong with a market capitalization of about €14 billion, is Italy’s largest luxury fashion group by revenue, reporting €5.4 billion in 2024—a 17% increase from the previous year.

A Brief History of Versace: Bold, Baroque, and Iconic

The Birth of Versace

Founded in 1978 by Gianni Versace, Versace emerged as a symbol of opulence and sensuality, embodying the vibrant spirit of southern Italy. Known for its Medusa head logo, baroque prints, and daring silhouettes, Versace became synonymous with glamour, attracting celebrities and fashion icons like Madonna and Princess Diana. Gianni’s tragic murder in 1997 thrust his sister, Donatella Versace, into the role of creative director, where she continued to champion the brand’s bold aesthetic for nearly three decades.

Versace’s Ownership Journey

Versace remained family-owned until 2018, when Capri Holdings (then Michael Kors Holdings) acquired it for $2.15 billion, aiming to build an American luxury empire alongside Michael Kors and Jimmy Choo. However, Capri struggled to position Versace in the era of quiet luxury, where understated elegance overshadowed the brand’s flashy designs. By 2024, Versace reported $1 billion in revenue but was operating at a loss, with a 15% revenue drop in the third quarter of fiscal 2025. Capri’s failed merger with Tapestry in 2024, blocked by U.S. antitrust regulators, forced the company to divest Versace to reduce debt and refocus on Michael Kors.

The Prada-Versace Acquisition: Reshaping Luxury Fashion

The $1.4 Billion Deal

On April 10, 2025, Prada Group announced its acquisition of Versace from Capri Holdings for €1.25 billion ($1.38 billion), a significant discount from the $2.15 billion Capri paid in 2018. The all-cash deal, funded by €1.5 billion in new debt, is expected to close in the second half of 2025, pending regulatory approvals. Prada’s chairman, Patrizio Bertelli, hailed the acquisition as a step toward building a new chapter for Versace, emphasizing shared values of creativity, craftsmanship, and heritage.

Strategic Leadership Changes

The acquisition coincides with a creative shakeup at Versace. In March 2025, Donatella Versace stepped down as chief creative officer, transitioning to the role of chief brand ambassador to oversee red-carpet dressing and philanthropy. Dario Vitale, formerly Miu Miu’s head of design, was appointed Versace’s creative director, marking the first time the role has been held outside the Versace family. Vitale’s appointment, described as an independent decision, is seen as a strategic move to refresh Versace’s aesthetic while aligning it with Prada’s operational expertise.

Recent Performance: Prada vs. Versace

Prada’s Resilience Amid a Luxury Slowdown

Despite a global slowdown in luxury demand, Prada has outperformed the market, driven by Miu Miu’s viral micro-miniskirts and satin ballet shoes. In 2024, Prada Group’s revenues grew 17% to €5.4 billion, with Miu Miu nearly doubling its profits. Prada’s minimalist aesthetic and Miu Miu’s youthful energy have resonated with diverse customer segments, allowing the group to defy industry headwinds. The appointment of Andrea Guerra as CEO in 2023 and the growing influence of Lorenzo Bertelli, Miuccia and Patrizio’s son, signal a generational transition aimed at sustaining long-term growth.

Versace’s Struggles Under Capri

Versace, under Capri Holdings, faced challenges adapting to shifting consumer preferences. The brand’s bold, logo-heavy designs clashed with the quiet luxury trend, leading to a 15% revenue decline to $193 million in Q3 2025. Capri’s broader struggles, including a failed Tapestry merger and Michael Kors’ declining performance, left Versace underfunded and unable to realize its $1.5 billion revenue goal. Analysts note that Versace’s brand recognition, ranking among the top 10 globally, far outweighs its financial performance, suggesting significant untapped potential.

Does the Acquisition Make Sense?

Strategic Synergies

The Prada-Versace acquisition is a bold move that positions Prada as a serious contender in the global luxury market. Here’s why it makes sense:

Complementary Aesthetics: Prada’s minimalist, intellectual style contrasts with Versace’s flamboyant, sensual designs, allowing the group to target diverse customer segments. As Lorenzo Bertelli noted, “There are no overlaps in terms of creativity, in terms of customers.” This diversity strengthens Prada’s portfolio, reducing reliance on Miuccia Prada’s creative vision.

Operational Expertise: Prada’s robust infrastructure, honed through years of investment, can revitalize Versace’s operations. Prada’s expertise in retail execution, supply chain management, and industrial capabilities will help Versace scale efficiently, addressing Capri’s shortcomings.

Reviving ‘Made in Italy’: The deal revives hopes for a Made in Italy luxury champion, countering the dominance of French conglomerates like LVMH and Kering. Italy accounts for 50-55% of global luxury goods production, yet lacks a group with LVMH’s scale. By bringing Versace back under Italian control, Prada strengthens its national identity and global competitiveness.

Long-Term Growth Potential: Versace’s global brand recognition and $1 billion revenue base offer significant growth opportunities. Prada’s CEO, Andrea Guerra, emphasized a long-term approach, stating, “The journey will be long and will require disciplined execution and patience.” With Prada’s resources, Versace could achieve Capri’s $1.5 billion revenue target.

Challenges and Risks

Despite its potential, the acquisition faces hurdles:

Market Volatility: The deal was struck amid geopolitical risks, including U.S. tariff uncertainties under President Trump’s policies, which could disrupt global supply chains. Both Prada and Versace, with widespread customer bases, are exposed to these risks.

Creative Transition: Dario Vitale’s appointment as creative director introduces uncertainty. While his experience at Miu Miu and Prada is promising, redefining Versace’s aesthetic without alienating its core audience will be challenging, especially in a market favoring quiet luxury.

Debt Burden: Prada’s €1.5 billion debt to fund the deal increases financial risk, particularly if Versace’s turnaround takes longer than expected. The group’s past acquisitions, like Jil Sander and Helmut Lang, were deemed “strategic mistakes,” raising caution about integration challenges.

Cultural Integration: Merging two brands with distinct identities—Prada’s intellectual north and Versace’s sensuous south—requires careful management to preserve Versace’s creative DNA while leveraging Prada’s operational strengths.

The Future of Prada and Versace: A New Chapter in Luxury Fashion

The Prada acquisition of Versace is a transformative step toward creating an Italian luxury powerhouse. By combining Prada’s operational prowess with Versace’s iconic brand equity, the deal has the potential to reshape the luxury fashion landscape. Prada’s track record of revitalizing Miu Miu suggests it can unlock Versace’s untapped potential, provided it navigates market uncertainties and creative transitions effectively.

For fashion enthusiasts, this acquisition is a thrilling convergence of opposites—Miuccia Prada’s cerebral elegance meeting Donatella Versace’s unapologetic glamour. As Donatella herself said, “I am honored to have the brand in the hands of such a trusted Italian family business.” The friendship between Miuccia and Donatella, forged over paninis and shared laughs, adds a personal layer to this corporate milestone, promising a collaborative spirit as Versace embarks on its next era.

Conclusion: A Bold Bet on Italian Luxury

The $1.4 billion Prada-Versace deal is a strategic masterstroke that capitalizes on complementary strengths, operational synergies, and the enduring appeal of Made in Italy. While risks like market volatility and creative transitions loom, Prada’s ambition to rival LVMH and Kering signals a new chapter for Italian fashion. As the luxury industry watches closely, one thing is clear: the union of Prada and Versace is poised to make waves, redefining what it means to be a global luxury brand in 2025 and beyond.

Leave a Reply